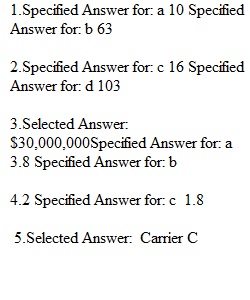

Q Question 1 The next three questions (1-3) are based on chapter 7 problem 1 on page 213. Dulaney's current profit margin is [a]% (round answer to nearest counting number) 2 out of 2 points Dulaney's current returan on assets (ROA) is [b]% (round answer to nearest counting number) Question 2 Suppose COGS and merchandise inventory were each cut by 10%. The new profit margin is [c]%. (round answer to nearest counting number) The new ROA is [dQuestion 3 2 out of 2 points Based on the current profit margin, how much additional sales would Dulaney have to generate in order to have the same effect on pretax earnings as a 10% decrease in merchandise costs? (answer in format of $500,000) %. (round answer to nearest counting number)Question 4 The next two questions (4-5) are based on Chapter 7 Problem 6 on page 214. The weighted average performance for Carrier A = [a] The weighted average performance for Carrier B= [b] The weighted average performance for Carrier C = [c] 5.If the weights for price, quality, and delivery shifted to 0.6, 0.2, and 0.2, respectively, which carrier is best?

View Related Questions